Planning for Growth

The Goshen Local School District will have a 2.9 mill bond issue on the March 2024 ballot.

Our community is growing rapidly, with more than 1,000 homes scheduled to be built and five neighborhoods already under construction.

According to the Ohio Facilities Construction Commission, Goshen’s school buildings are already over capacity. The district is projected to grow by hundreds of students in the coming years.

The Goshen Board of Education is seeking approval of the first phase of a multi-phase plan designed to maintain quality education while preparing enrollment growth.

Using input from the community, GLSD developed a phased approach to adding classroom space, the district’s most pressing need.

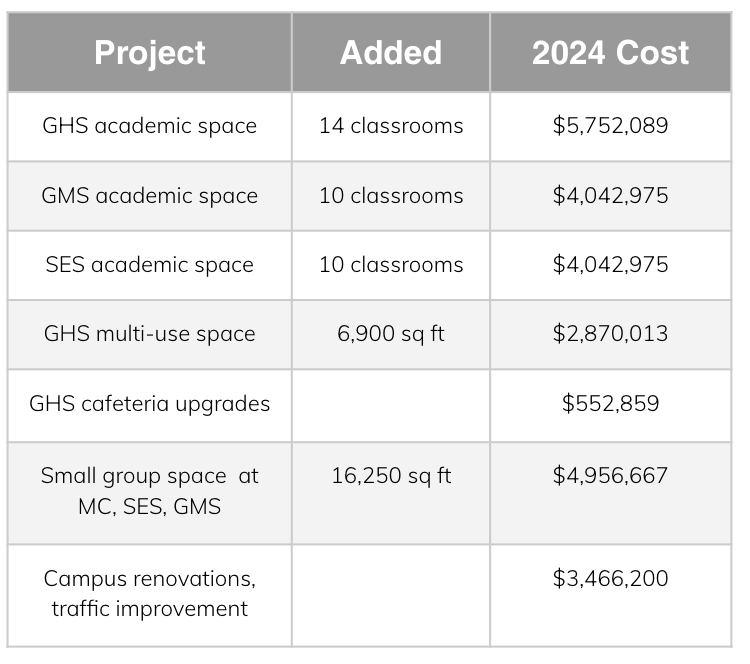

Phase I would call for no new school buildings, only additions to existing buildings (see chart below), at a total cost of approximately $26 million.

This will allow the district time to monitor enrollment growth and refine the master plan for Phase II and the next 10 to 15 years.

Bond Issue Info

2.9 mills will raise approximately $26 million to finance Phase I of the district master facilities plan. Phase I covers new classroom space and improvements to campus traffic and safety.

This ballot request will cost $8.50 per month for the owner of a home with an appraised value of $100,000. The Board responded to the community’s concerns with an adjusted, multi-phase plan.

1999 was the last time a bond issue request for GLSD facilities was approved by voters. That bond was paid off 3 years early. Prior to 1999, the last facilities ballot issue was in 1976.

Our community is growing rapidly, with more than 1,000 homes scheduled to be built and five neighborhoods already under construction.

Goshen’s school buildings are already more than 300 students over the capacity they were designed for. This overcrowding impacts teaching and learning daily.

GLSD found a unique opportunity to save dollars on this bond request: The district sought and was approved for USDA loan, which reduces this bond’s interest rate, saving over $4 million during the life of the bond. The interest rate does not apply without voter approval of the bond issue.